Federal Agencies Relax Contraceptive Coverage Mandate

New Rules Expand Exemptions Based on Religious and Moral Objections Effective as of October 6, 2017, two companion interim final rules issued by the U.S. Departments of Health and Human Services, Treasury, and Labor expand exemptions related to the Affordable Care Act requirement that non-grandfathered group health plans provide coverage without cost-sharing for contraceptive services (referred to as […]

PCORI Fees Hiked for 2018 Filing Period

Fee Applies to Certain Self-Insured Plans The Internal Revenue Service (IRS) recently announced an increase in the applicable dollar amount used to determine the Patient-Centered Outcomes Research Institute (PCORI) fee for plan years that end on or after October 1, 2017 and before October 1, 2018. As a reminder, employers sponsoring certain self-insured plans are […]

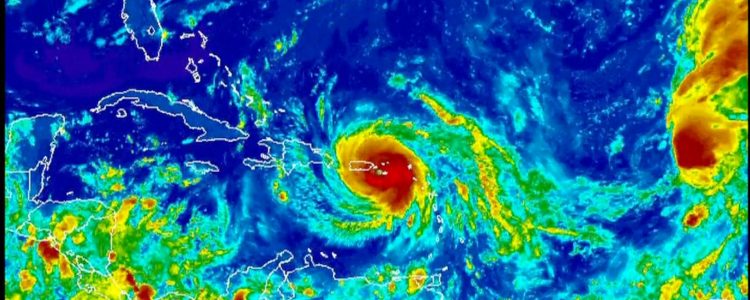

Marketplace Special Enrollment Periods Announced for Hurricane-Impacted Individuals

Special Enrollment Periods Available for 2017 Marketplace Coverage As a result of Hurricanes Harvey, Irma, and Maria, the Centers for Medicare & Medicaid Services (CMS) will make available special enrollment periods for certain individuals seeking health plans offered through the Federal Health Insurance Marketplace (Exchange). In general, these special enrollment periods are available to residents of Florida, […]

Medicare Announces Special Enrollment Period for Individuals Impacted by Recent Hurricanes

Special Enrollment Period Available Through 2017 As a result of Hurricanes Harvey, Irma, and Maria, the Centers for Medicare & Medicaid Services (CMS) will make available a special enrollment period for all Medicare beneficiaries to enroll, dis-enroll, or switch Medicare health or prescription drug plans. In general, this special enrollment period is available to residents of Florida, […]

IRS Releases Final 2017 Forms 1094 and 1095

Final Form Instructions Not Yet Released The IRS has released the final Forms 1094-B, 1095-B, 1094-C, and 1095-C for calendar year 2017 reporting. Employers are required to report in early 2018 for calendar year 2017. 2017 Forms The following forms are now available for calendar year 2017 reporting: Form 1094-B (transmittal) Form 1095-B Form 1094-C (transmittal) Form 1095-C […]

USCIS No Longer Taking Petitions Under H-2B Increase

Agency Will Deny Petitions Not Approved Before October 1 The U.S. Citizenship and Immigration Services (USCIS) has announced it is no longer accepting petitions from U.S. employers seeking to hire temporary nonagricultural workers under the one-time increase to the Fiscal Year (FY) 2017 H-2B cap announced in July. Petitions submitted but not approved by USCIS before October […]

IRS Issues Special Per Diem Rates for 2017-2018

Rates Effective On or After October 1, 2017 The Internal Revenue Service (IRS) has released an annual notice that provides the 2017-2018 special per diem rates for taxpayers to use in substantiating the amount of ordinary and necessary business expenses incurred while traveling away from home. The rates are effective for allowances paid to employees on […]

Upcoming Deadline for Second Transitional Reinsurance Program Payment

Payment Due November 15 for Contributing Entities Opting for Two-Part Contribution The second transitional reinsurance contribution payment for the 2016 benefit year is due by November 15, 2017, for issuers and certain self-insured group health plans (referred to as “contributing entities”) that did not previously pay the entire 2016 benefit year contribution in one payment. The contributions are […]

Applied Resource Insurance Solutions Is Moving!

Applied Resource Insurance Solutions is happy to announce that we are moving our office! We are moving into a bigger location off Avenue Stanford here in Valencia! Please update your records with our new address: 25060 Ave Stanford, Suite 295 Valencia, CA 91355

Minimum Wage for Covered Federal Contract Workers Will Rise to $10.35 Per Hour

Rate for Tipped Employees Rises to $7.25 Per Hour The U.S. Department of Labor (DOL) has announced that the minimum wage for workers performing work on or in connection with certain federal contracts will rise to $10.35 per hour ($7.25 per hour for covered tipped employees) beginning January 1, 2018. Background Executive Order 13658 established a minimum wage requirement for […]